How can PaperFree help you automate your Loan Processing?

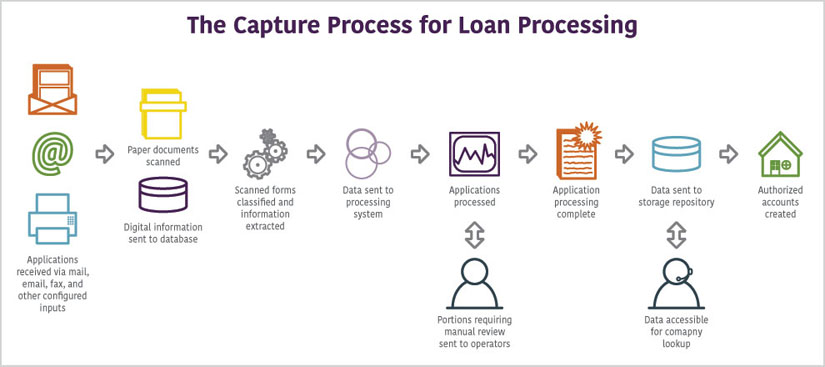

![]() Streamlining the entire loan processing process can be easy with PaperFree. From receipt of documents then through data capture, processing, and archiving, our solutions enable your enterprise to manage your workflows easily and affordably. These solutions for mortgage processing enable banks, financial institutions and credit unions to dramatically transform and simplify information intensive customer interactions. Financial institutions can engage customers and brokers at their point of origination, providing them with the ability to submit required documents in support of the loan application—via the web, mobile device, email or in the branch. PaperFree's loan processing solutions combine market leading capture, process management, mobile and analytics capabilities to significantly increase responsiveness to potential borrowers, improve service expectations and gain a competitive advantage with interactive workflows that expedite the loan process. And, since everything is digitzed there are no more lost documents or applications that end up on the wrong desk.

Streamlining the entire loan processing process can be easy with PaperFree. From receipt of documents then through data capture, processing, and archiving, our solutions enable your enterprise to manage your workflows easily and affordably. These solutions for mortgage processing enable banks, financial institutions and credit unions to dramatically transform and simplify information intensive customer interactions. Financial institutions can engage customers and brokers at their point of origination, providing them with the ability to submit required documents in support of the loan application—via the web, mobile device, email or in the branch. PaperFree's loan processing solutions combine market leading capture, process management, mobile and analytics capabilities to significantly increase responsiveness to potential borrowers, improve service expectations and gain a competitive advantage with interactive workflows that expedite the loan process. And, since everything is digitzed there are no more lost documents or applications that end up on the wrong desk.

Key Benefits

- End-to-end management – Integrate all key processes, from receipt and approval to archiving and auditing—and provide complete visibility into the entire process.

- Control and compliance – Retain and archive documents in compliance with government and company policies.

- Streamlined work – Provide users with a streamlined user interface that offers seamless integration between data from other systems and full views of all supporting documentation.

- Customer responsiveness – Quickly retrieve up-to-date, accurate customer information, and respond promptly to customer inquiries.

- Elimination of paper storage – Eliminate the need for physical paper storage—digitize all documents and take advantage of records retention and storage capabilities.

Let PaperFree help you get started by analyzing your current operation and learn just how quickly you can be fully automated and processing your loan documents faster and easier than ever before.