How can Captiva Tax Processing automation help your Federal, State, or Local government?

PaperFree has extensive experience helping governments to overcome their paperwork burdens effectively and efficiently. We have assisted entities from city all the way to federal levels to implement class-leading enterprise content management solutions to streamline paperwork, applications, and process tax returns quickly and accurately.

![]() If any organization is known for endless volumes of paper it's government. Applications, permits, contracts, taxes...the list goes on. And with this list comes the incredible burden of tax processing in a way that is fast, accurate, and in compliance. PaperFree aims to ease this burden for governments through the use of information capture technologies and strategic outsourcing solutions to more effectively digitize data, process it, and make it available for easy future lookup. Our solutions have been proven time and time again as leaders in tax processing solutions.

If any organization is known for endless volumes of paper it's government. Applications, permits, contracts, taxes...the list goes on. And with this list comes the incredible burden of tax processing in a way that is fast, accurate, and in compliance. PaperFree aims to ease this burden for governments through the use of information capture technologies and strategic outsourcing solutions to more effectively digitize data, process it, and make it available for easy future lookup. Our solutions have been proven time and time again as leaders in tax processing solutions.

How does it work?

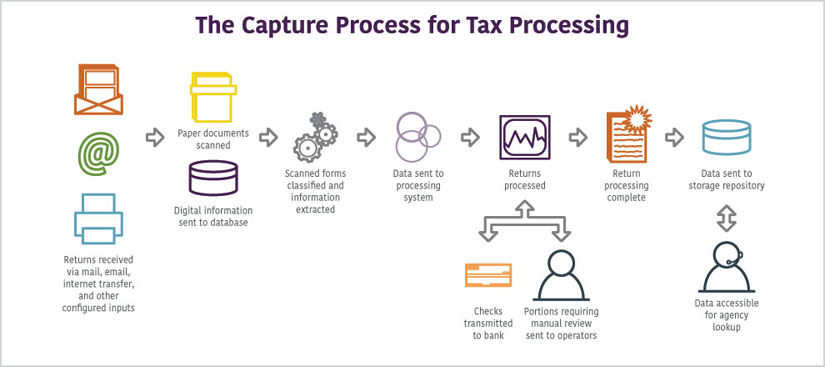

- A capture system needs data to run - and the first step is to gather documents to process. Typically, these invoices arrive in paper form, but they can also be sourced from email inboxes, faxes, or other configured electronic inputs.

- Next, data is introduced into the capture system by scanning paper documents or importing electronic files into a processing queue.

- Once documents exist as digital images in the queue, their information is analyzed and business-critical information such as names, reference numbers, and dollar amounts are extracted and digitized.

- This digital information is then exported to a customized workflow where it is processed and is routed to the appropriate operators if needed. All of this happens automatically, and once manual steps (such as a management approval) are completed the document continues on to its next step with no additional action required on the operator's part.

- Once data capture and workflow processing are complete, the information as well as the data about its related transaction(s) are exported to a storage repository. Here, it can be stored for compliance or can be easily pulled up by operators for customer service, management, or training needs.

Key Benefits

- Accurate – advanced recognition technology ensures high confidence in the accuracy of captured data.

- Fast – captured data can be sent to a backend system for automated processing.

- Easy compliance – store digital records more easily than paper for the required time.

- Easy lookup – digital records can be easily retrieved for later review and analysis.

Information Capture Solutions

PaperFree provides leading technologies that bring significant automation to the processing of tax forms. These solutions are ideally suited for high volume complex forms processing which is indicative of the demands placed on most state and federal tax processing operations. Through the use of IDR (Intelligent Document Recognition) technology, tax processors are now able to process forms without the historical limitations typically found in most ICR/OCR solutions. Here are some of the benefits tax processors are now able to reap from this cutting edge technology:

- Classification of mixed batches - tax customers can now significantly reduce the amount of prep and sorting once required for automation such as payments from non-payments, varying tax years, and even varying tax types.

- Unstructured forms processing - once considered 'impossible' by many, the solutions PaperFree provides now boast the ability to consistently process unstructured forms such as W-2's with a high rate of success. Through the use of intelligent extraction methods, the technology is able to find and locate key pieces of information anywhere on a form and extract that data at speeds that provide the ability to easily process the sort of high volumes required during peak tax processing periods.

- Check Processing and Full Page document processing within the same platform - traditionally, check remit processing for tax processors meant processing with two separate platforms. One to handle the full page documents or remittance advice and the other to handle the check (often accompanied by an manually created voucher). Through the use of advanced classification technology and solution consolidation by PaperFree, tax processors can essentially 'stack and scan' mixed batches including those that include payments.

Strategic Outsourcing Solutions

Through the use of vCapture™, tax processors are now able to reap the benefits associated with both worlds - in house processing and outsourcing. vCapture™ is a product and service that integrates directly into a tax processor's in-house information capture solution and provides the means for them to utilize a virtual workforce of thousands of data entry keyers via the internet 24 hours a day, 7 days a week. vCapture™ is 100% secure and provides dual-source verification which ensures 100% accurate data each and every time.

Let PaperFree evaluate your enterprise's Accounts Payable needs and learn just how quickly you can be fully automated and processing payables faster and easier than ever before.