Are you processing checks in-house today or utilizing expensive lockbox services? DepositCritical offers easy, inline and in-house check processing to eliminate your payment headaches.

Businesses process their check-based payments in a variety of ways, but nearly all require significant amounts of manual intervention; handling of checks and coupons, research, and multiple quality checks to catch any human errors. Many companies take on this burden themselves, or pay the high price of outsourcing it to a bank or other lockbox service. The result is checks that must be separated from their accompanying payment information and from your facility, where they can be lost, miskeyed, or encounter any sort of hiccup that can delay settling accounts and receiving revenue. DepositCritical was created to solve all of these common problems easily and without additional manual steps.

Businesses process their check-based payments in a variety of ways, but nearly all require significant amounts of manual intervention; handling of checks and coupons, research, and multiple quality checks to catch any human errors. Many companies take on this burden themselves, or pay the high price of outsourcing it to a bank or other lockbox service. The result is checks that must be separated from their accompanying payment information and from your facility, where they can be lost, miskeyed, or encounter any sort of hiccup that can delay settling accounts and receiving revenue. DepositCritical was created to solve all of these common problems easily and without additional manual steps.

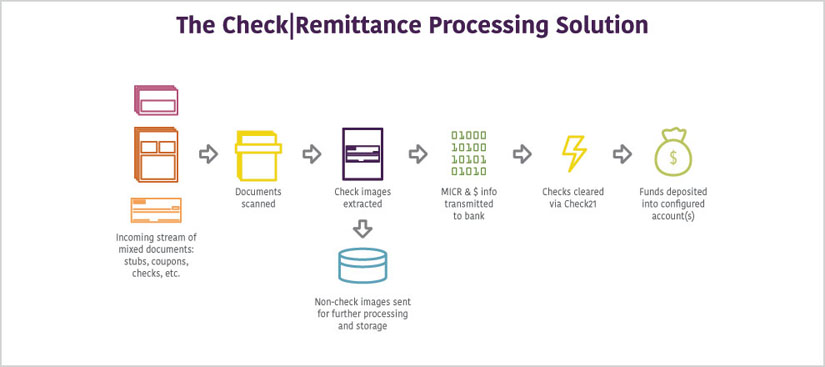

DepositCritical is a unique check processing system that works inline with your existing OpenText Captiva system. With this integration checks are automatically recognized in the incoming stream of scanned work and their data is extracted and sent for further automatic processing through your bank. Checks never your premises and data is automatically captured for exceptionally accurate processing via Check21 depositing methods. And, DepositCritical can even recognize when a check is intended to cover more than one payment and process it appropriately. You'll enjoy easier receipt of payments and eliminate the hassles that come with running an additional manual processing line. To find out how DepositCritical can help your organization process incoming checks faster, more accurately, and for less give us a call or request a demo today.

How Does it Work?

DepositCritical sources its work from your Captiva system's stream of incoming scanned documents, such a payment stubs, documents, coupons, checks, and more. These documents don't need to be separated by type either - Captiva can automatically recognize the type and content of a document in a mixed stream based on set recognition templates. Once DepositCritical identifies a check image in the data, it collects important attributes of it, such as the Pay To line, amount, associated account number, and MICR banking data. Using this data, it checks it against customer accounts and identifies associated payments due. Where DepositCritical shines is that it can automatically identify where a check is being used to cover multiple payments. This reduces manual processing and increases settlement of accounts. With the check data digitized and payment identified, the information is then sent to the payor's bank for electronic processing and quick return of funds to your configured account(s). The check never leaves your premises and its data is stored within your content management system for easy lookup later.

Key Benefits

- Streamlined – no need to separate payments into their own workflow.

- Process structured and unstructured documents – quick and automatic recognition.

- Clear payments in-house – no need for expensive lockbox services or removing checks from your premises.

- Multiple payments – DepositCritical can identify and process multiple transactions with one check to cover them all.